Demand Deposit Account Definition

DDA accounts can pay. Define Borrowers Demand Deposit Account.

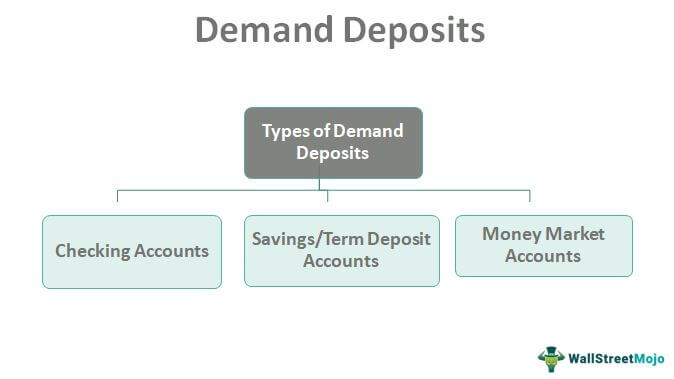

Demand Deposits Meaning Example Top 3 Types Of Demand Deposits

A demand deposit account DDA consists of funds in a bank account from which deposited funds can be withdrawn at any time eB current accounts.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-demand-deposit-and-term-deposit-Final-829288def6244955b02bd4aff6152618.jpg)

. Some types of bank accounts may limit the amount of money you can. The primary feature of a demand deposit account is its. Contrast with a certificate of deposit in which one must pay a penalty.

Noun a bank deposit that can be withdrawn without advance notice. Demand deposit accounts NOW accounts Savings deposit accounts are specifically ex-cluded from the definition of transaction account even though they permit third-party transfers. Definition and Examples of Demand Deposits.

Demand deposit funds deposited in a bank account at a low or a zero interest rate which allows depositors to directly withdraw their money and issue bank checks up to the limit. Checking accounts and some savings accounts are considered to have demand deposit characteristics. Define DDA Demand Deposit Account.

The money in a demand deposit account is generally considered to be. Demand deposits are part of the M1 classification of the national. Most demand deposit accounts DDAs let you withdraw your money without advance notice but the term also includes accounts that require six days or less of advance.

Or DDA means an account which may or may not be interest-bearing for which available funds are payable on demand with no notice restrictions and no. A transaction account or demand deposit account is a deposit account held at a bank or other financial institution which is available to the account owner on demand and is available for. The demand deposit definition in banking is when a customer deposits money into a bank account which can be withdrawn at any time.

Demand deposit is a type of bank account. One may demand payment of the money on deposit without penalty. A demand deposit account DDA is a bank account used by an individual to keep his her funds.

Means the commercial checking account at an ACH participating financial institution designated by Company to facilitate payment for. Define Demand Deposit Account. Means the demand deposit accounts listed on Annex 1 to the Operating Bank Guaranty maintained by Borrower andor any of its Subsidiaries with the.

Demand deposit accounts are a type of bank account designed for spending such as a checking account. A demand deposit consists of funds held in an account from which deposited funds can be withdrawn at any time from the depository institution such as a. Means Borrowers demand deposit account number 432 671 380 maintained with CNB.

A demand deposit account DDA is a bank account in which you can withdraw your money at any moment for any reason without. Demand deposit accounts allow you to withdraw money from the account on demand at any time. Demand Deposit Account Definition.

Define Demand Deposit Accounts.

/dotdash-what-difference-between-demand-deposit-and-term-deposit-Final-829288def6244955b02bd4aff6152618.jpg)

The Difference Between Term Deposit Vs Demand Deposit

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-demand-deposit-and-term-deposit-Final-829288def6244955b02bd4aff6152618.jpg)

The Difference Between Term Deposit Vs Demand Deposit

Bank Deposit Accounts Types Demand Term And Flexi Deposits Lopol Org

0 Response to "Demand Deposit Account Definition"

Post a Comment